Self Managed Superannuation Fund (SMSF)

What is SMSF SMSF is a superannuation trust structure which is a private superannuation fund and is regulated by the Australian Taxation Office (ATO) that you manage it yourself

Peace of Mind | Solution to your Tax and Business Needs | Based in Parramatta

Affordable Fixed Fee which is completely deductible in tax return

We use Tax Specialists to minimise your tax and maximise your tax refund

We take your worries away because we are a team of Tax Specialists and Accountants

We ensure you are well taken care by staying compliant

We help free your time doing your own books and returns by using cloud software

Let us grow your business through timely reporting

Keven Rivera Teos23/09/2024I was stuck with finding a good tax consultancy for my tax returns, until I was lucky to have been recommended Ezy Tax Consultants. The team helped me with my tax return and I was satisfied with their service and communication. I recommend this Consultancy if anyone has any enquiries.

Keven Rivera Teos23/09/2024I was stuck with finding a good tax consultancy for my tax returns, until I was lucky to have been recommended Ezy Tax Consultants. The team helped me with my tax return and I was satisfied with their service and communication. I recommend this Consultancy if anyone has any enquiries. Nandya Priyandana31/07/2024Very happy with Amelia's professional advice & service on anything tax-related.

Nandya Priyandana31/07/2024Very happy with Amelia's professional advice & service on anything tax-related. Reza Negarestani21/07/2024I'm highly satisfied

Reza Negarestani21/07/2024I'm highly satisfied tony -09/05/2024Great customer service Kind regards

tony -09/05/2024Great customer service Kind regards shamal nn01/05/2024Ezy Tax Consultants exceeded my expectations, and a big part of that was thanks to Amelia. She was diligent, informative, and transparent throughout the entire process. I felt completely confident in her expertise and would highly recommend Ezy Tax for their excellent service under Amelia's guidance.

shamal nn01/05/2024Ezy Tax Consultants exceeded my expectations, and a big part of that was thanks to Amelia. She was diligent, informative, and transparent throughout the entire process. I felt completely confident in her expertise and would highly recommend Ezy Tax for their excellent service under Amelia's guidance. don wong14/03/2024Amelia is very experience accountant. She always able to give the best solution for me and my family. Highly recommended..!!!

don wong14/03/2024Amelia is very experience accountant. She always able to give the best solution for me and my family. Highly recommended..!!! Yogo K13/03/2024Amelia is knowledgeable, professional, capable and experienced in her tax /smsf industry - she is helpful towards your thoughtout questions. This is my respectful-5-star review for Amelia

Yogo K13/03/2024Amelia is knowledgeable, professional, capable and experienced in her tax /smsf industry - she is helpful towards your thoughtout questions. This is my respectful-5-star review for Amelia

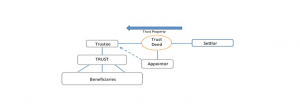

What is SMSF SMSF is a superannuation trust structure which is a private superannuation fund and is regulated by the Australian Taxation Office (ATO) that you manage it yourself

There are many types of trusts that are setup to protect financial assets and income from claims against the beneficiaries or trustee. Deceased estate trust Discretionary trust Fixed trust

Why do we setup a trust? To separate the owner of the asset (the beneficiary) and control over that asset (the trustee). Greater flexibility in tax planning. To protect

Leave us a message