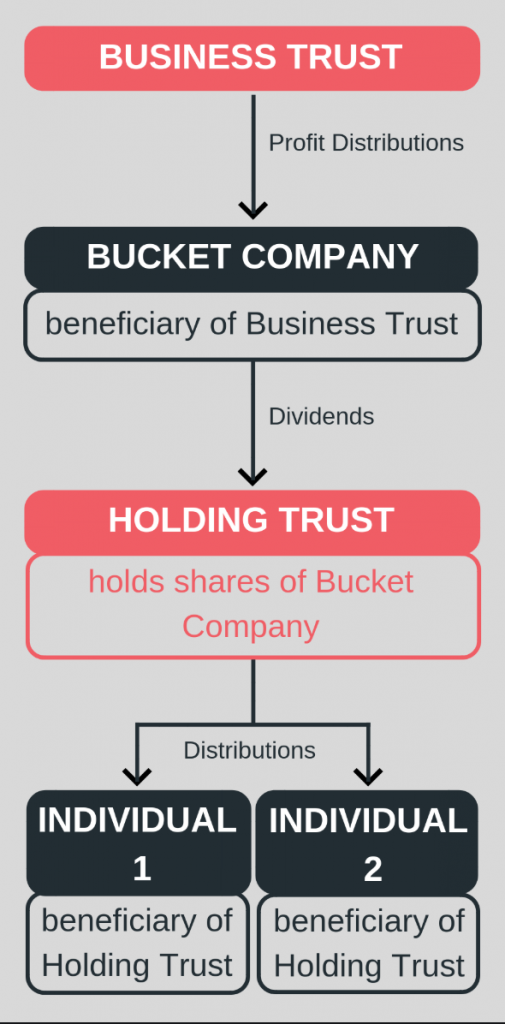

How Bucket Company works in Family Trust

The strategy of a Bucket Company is surprisingly useful for a family trust to cap the amount of tax you or your family members need to pay. The term ‘bucket‘ is used because company sits below a trust and it is used to distribute income to it. It is good for tax planning and minimisation. …