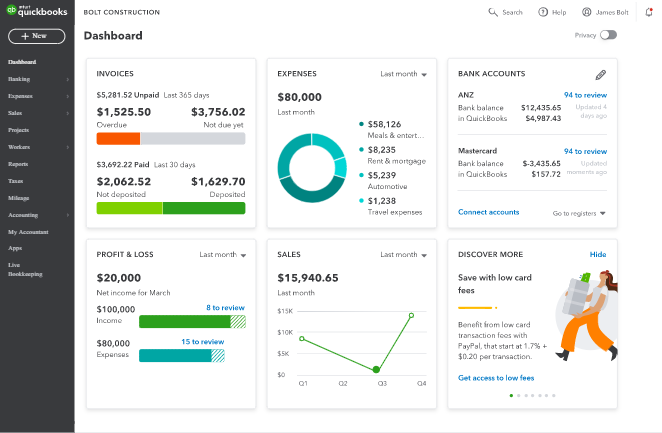

QuickBooks Online

Running a small business is not easy. You have to think of business names, marketing, invoicing, receiving payments from customers, dealing with inqueries etc. Hence, having a system in place whether you are a small or big business is utmost important which can free up your time from the mundane routine administration tasks.

Finding the best small business accounting system consumes time. There are so many options in the market. In this article, I will review and compare the best accounting software for your businesses.

QuickBooks has been one of the biggest names in accounting for 30+ years. It began as a desktop application, but now has a cloud-based online counterpart: QuickBooks Online.

QBO is a true double-entry accounting tool with plenty of reporting and a strong chart of accounts. It offers invoicing, payroll function which is called KeyPay, and inventory management, a project management tool, as well as an impressive 200 integrations with other tools.

The KeyPay which is the payroll function requires a lot of detail input to be setup for payrun. The payrun functions are a little messy compared to Xero. However, they generate quite a comprehensive payroll report which is the same as MYOB.

Most bookkeepers and accountants will know how to use QuickBooks. In other words, when you outsource to anyone with accounting background they would be able to pick up quickly.

That said, QuickBooks is a generic product designed for everyone, which means it comes bloated with a lot of features you’ll probably never use. For instance, inventory management is a big part of the software, which is irrelevant to a lof of businesses these days that don’t deal with physical inventory.

And since it has a lot of features in the way, it’s hard to navigate for users who have no accounting knowledge and skills. It doesn’t have a clean, easy-to-follow workflow like Xero (unless you have accounting experience).

QuickBooks Feature List

- Connect multiple bank accounts

- Track inventory and per item cost

- Manage bills and vendors

- Manage invoices and accounts receivable

- Create custom invoices

- “Pay now” buttons for instant payments

- Dashboard overview

- Simple reporting

- Share access with accountant

- Receipt tracking

- Payroll for employees and taxes

- Track sales, payments, and expenses

- Mobile apps (use QuickBooks anywhere)

- Lots of integrations

- Profit and loss and balance sheets

- Pay online and print checks

- Mobile receipt capture

- Create estimates

- Banking data synchronization

- Automatic tax calculations

The Bottom Line

QuickBooks Online is a great accounting product, but it tries to be something for everyone, which means it’s a bigger tool than most small businesses need. Finding the things you need within the app can be tough because there’s just so much to explore.

However, Intuit’s support is instant with an online chat, community forum and a phone support when users require technical support.

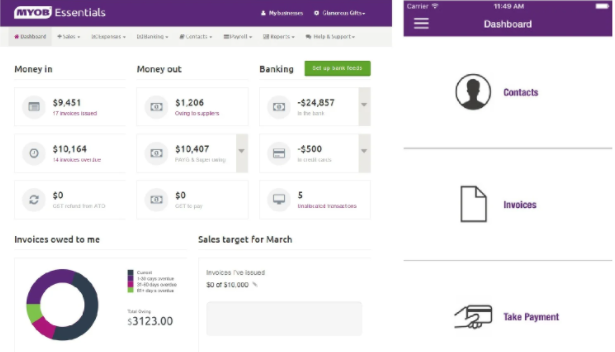

MYOB

MYOB – short for “Mind Your Own Business” is the Australian equivalent of QuickBooks. It comes with a range of features for both big and small businesses.

MYOB was originally a Windows-based desktop application. It comes with all the typical accounting features, along with payroll, budgeting, and project management tools. It’s a traditional accounting software which is very suitable for accountants.

MYOB has moved to a cloud based platform which can be accessed by anyone remotely. However, it is not as progressive as Xero and QuickBooks online.

MYOB is the most expensive accounting system with starting price of $60 per month with unlimited payroll and most of the business functions except inventory.

MYOB Features List

- Works on and offline

- Calculate and track taxes

- Manage quotes, invoices, and statements

- Accept payments

- Track and pay expenses

- Manage customers and vendors

- Organize bank feeds

- Manage purchase orders

- Work with multiple bank accounts

- Pay employees and track leave

- Track employee time

- Job and project costing

- Create and track individual jobs

- Manage physical inventory

The Bottom Line

MYOB is a traditional accounting system, but it comes with significant limitations. It doesn’t allow multiple users, which means you can’t restrict access someone on your team or outsourced partners. In other words, they’ll have complete access to everything, like your payroll information and employee bank account details.

While the payroll feature is handy, there’s no employee portal where they can view or print their payslips, request leave, or change their banking details.

Unfortunately, MYOB’s cloud platform is way behind the accounting solutions, so we don’t recommend it for anyone who has no accounting background.

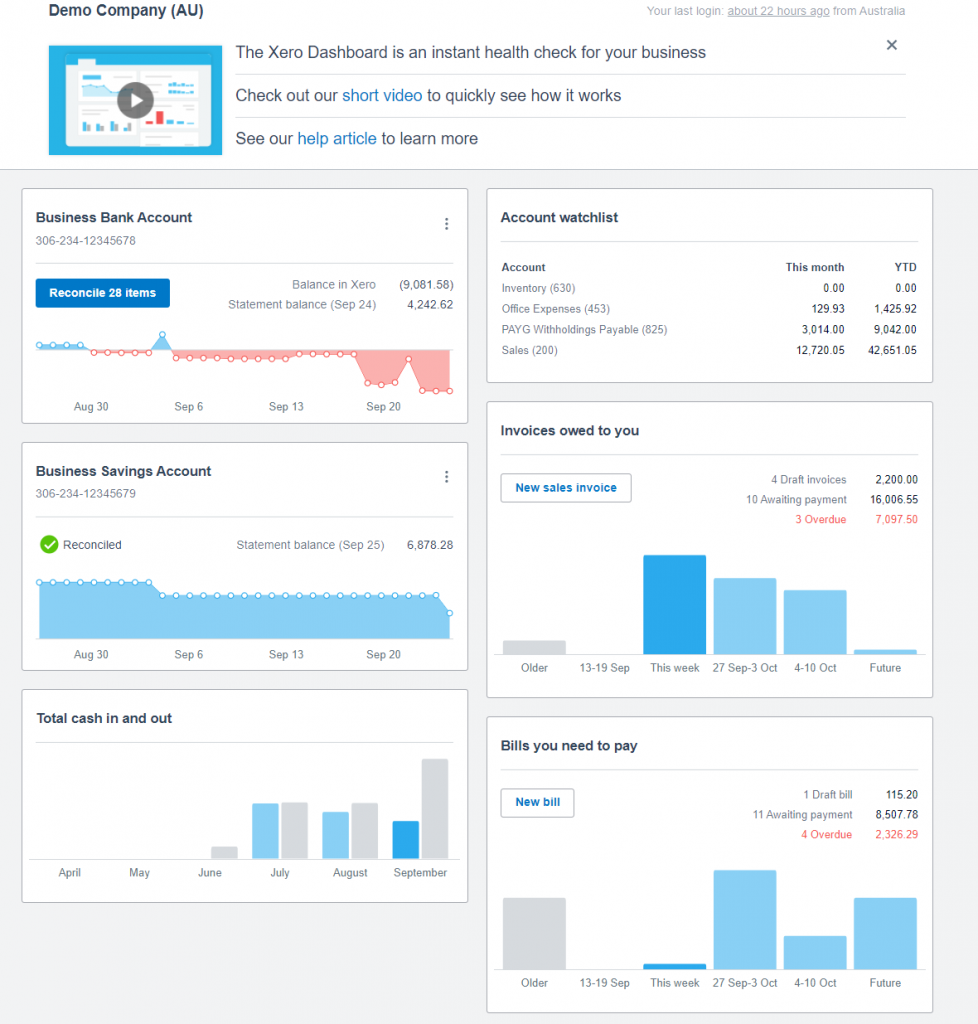

Xero is an accounting system that is made for non-accountants. It’s made with a single ledger. The multiple bank accounts feed into the software are made so seamlessly that you don’t require any forms to be signed and submitted to the banks for authorisation. The coding or categorisation takes one or three simple clicks/steps to allocate payments and receipts to the appropriate account codes. This easy simple steps makes the workflow quite different from other accounting tools. It’s user friendly and intuitive.

Xero is one of the few accounting solutions that includes full cycle payroll processing. Depending on the number of employees for payroll, Xero pricing starts from $25 per month. It gives the same function as both MYOB and QuickBooks online, it has the ability to process payruns, supports STP [Single Touch Payroll] and lodge an annual payment summary to the ATO.

Xero comes with plenty of financial reporting features, which is sufficiently important for all small business uses. It offers the customisation of reports, templates, emails according to your business needs.

One of Xero’s best features is their open API. Xero ties up with a lof of third party solutions that are complimentary for a lot of business uses. Their integration with most the software are so easy to setup. It is the most advance accounting solution for cloud based platform which supports majority function of any business. Xero’s documentation is public and robust to help developers link other products.

Xero Features List

- Bank reconciliation

- Keep track of suppliers and customers

- Simple dashboard

- Track and organize expenses

- Attach documents to your financial data

- Financial reporting

- Free, unlimited email support

- Inventory management

- Create and send invoices automatically

- Mobile apps (Android, iPhone/iPad)

- Multi-currency support

- Payroll processing (free up to five employees)

- Purchase orders

- Quick and easy 1099s

- Pay bills and invoices

- Track and manage projects

- Give out estimates and quotes

- Create smart financial reports

- Accept payments

- Receive bills electronically

- Segment contacts based on purchase history

- Fixed assets

- GST returns

The Bottom Line

The best part of Xero it supports auto invoicing reminders for outstanding and overdue invoices. Banking feed is seamless to setup. It integrates with Stripe, PayPal, GoCardLess for payments that makes receiving payments very easy. Although it is more expensive than QuickBooks Online, Xero is an easy platform to use for business owners with no accounting skills. It is a mobile friendly platform which you can use it on your mobile to issue invoices and receiving payments. It supports other non accounting functions such as CRM that is important for all businesses.

My Final Recommendation

It’s no secret that I strongly recommend Xero. Xero offers the perfect balance of features and benefits for all businesses use. However, Xero might not be the right option for you. Choose the best platform that suites your business workflow.