The strategy of a Bucket Company is surprisingly useful for a family trust to cap the amount of tax you or your family members need to pay. The term ‘bucket‘ is used because company sits below a trust and it is used to distribute income to it. It is good for tax planning and minimisation. This distribution of income from the trust to the bucket company allows your tax to be cap at a corporate tax rate.

Company tax rates

- 27.5% for 2018 to 2020

- 26% for 2020 to 2021

- 25% for 2021 to 2022

This structure becomes useful for you when your income threshold exceeds the marginal tax rate. Using a bucket company, you can get the opportunity to pay your personal income tax at a company income tax rate.

Who benefits from Bucket Company strategy?

Ideally:

- Investors or Business Owners

- Running their business or receiving income through a discretionary trust structure

- Not caught under the Personal Services Income (PSI) rules (if you don’t know what this is, hopefully the rules don’t apply, but you can read more on PSI here)

The idea of a bucket company is that they take ‘excess’ profits, after distributing a reasonable amount to the people within a family group.

Bucket Companies are incredibly useful

- For business owners who earn more than their cost of living, and want to build a nest egg for their family;

- When business owners are having big fluctuations in incomes between financial years as they can be used to make the tax bills more consistent; and

- For business owners coming up to retirement or selling their business, and no longer earning as much business income moving forward.

How does a Bucket Company work in a Trust

Bucket Company can save thousands of dollars in taxes as an individual year after year.

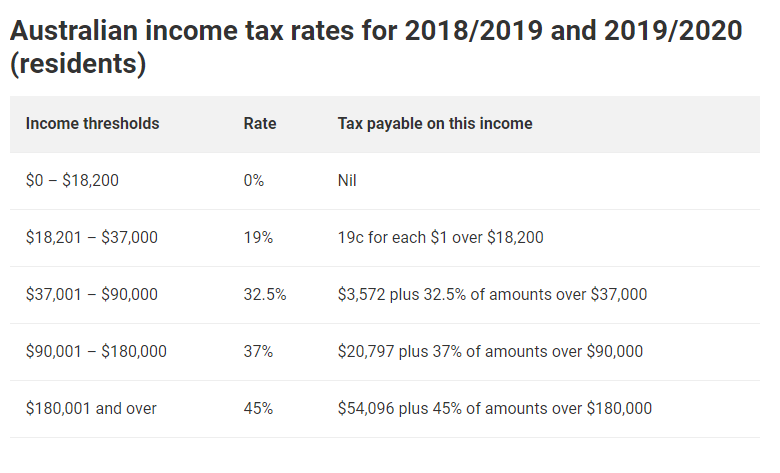

As you can see in comparison between personal and company tax rates as the personal income increases, the tax rates also increases on the dollar earned. In contrast with the company, the tax rate is flat at 27.5% in 2019 & 2020 for companies with turnover less than $50m. This is why Bucket Company is used to “cap” tax on profits distributed by a trust.

Example 1 we have a Trust that generates $300,000 in net profit. We can either distribute the net profit to the individual beneficiaries or company beneficiaries or both.

Scenario 1 – We distribute $150,000 to person A and $150,000 to person B. Referring to the table above, income above $90,000 -$180,000 has an estimated tax of $45,997 (37% tax rate). So, in total tax paid for both A and B are $92k.

Scenario 2 – We distribute $300,000 net profit to Person A $87,000 and Person B $87,000 and the remainder of $126,000 to the bucket company. Referring to the personal tax table above, person A and B – each has to pay tax of $19,822. As for the bucket company, the distribution income of $126k is taxed at 27.5% which the company has to pay tax of $34,650. So in this instant total tax paid by this group in this scenario 2 is $74,294.

When you compare Scenario 1 and Scenario 2 – we can see there is a tax savings of $17,706!

Example 2 – A Trust that has a net income of $500,000.

Scenario 3 – We distribute $250,000 net profit each to Person A and Person B. Referring to the tax table above, each pays individual tax of $85,596 (45% tax rate). So, in total both pay tax of $171,192.

Scenario 4 – We do the same thing – distribute $87,000 to Person A and $87,000 to Person B and the remainder of $326,000 to the bucket company. Person A and B each pays tax of $19,822. The bucket company pays a flat rate of 27.5% which is calculated to $89,650 company tax. So in total the group pays $129,294 taxes.

That’s a tax savings of $41,898 !!! ($171,192 less $129,294)

Do you need to pay cash to the Bucket Company

When the Trust distributes the profit to the company, it needs to pay cash to the Bucket Company. Otherwise, Div 7A loan is raised.

Div 7A is a loan agreement between the Trust that is distributing the profits and the company that is receiving them.

So how do we get the cash out of the Bucket Company

So the Trust distributes the cash to the Bucket Company, how how do we get the cash out from this bucket?

There are two (2) options that we can use:

- Loan from the Bucket company

- Pay dividends to the shareholders of the Bucket Company

Loan from the Bucket Company

With this option, your bucket becomes your bank that loans you money with principal and interests repayments that requires to be paid back to your bucket. This loan is called Dvision 7A loans and there are a few factors that require your consideration.

- Interests rate for the repayments are set by the ATO which is known as benchmark interest rate – 5.2% in 2019 and 5.37% in 2020.

- Unsecured loans must be repaid within seven (7) years

- Secured loans can be secured to a property and it requires 30 years to pay back

Bear in mind that Div 7A loans can become ugly if it is not correctly executed. Best is to work with an Accountant who knows this stuff.

Pay Dividends to the shareholders

The 2nd option is to use the money from the Bucket Company to pay dividend to its shareholders. But be mindful of a couple of important issues that need to be considered.

- We pay dividend to a shareholder. The shareholder gets taxed on the dividend which in return receive a franking credit that the company has already paid. Hence the impact on the tax they need to pay needs a careful consideration.

- Now dividends can only be distributed according to the percentage of shareholding in the company. Again this creates less flexibility to the shareholders. It also depends who the shareholders are. If the shareholders are earning income outside of the company, the tax minimisation strategy might not work well in this case.

Let’s explore the THIRD (3) option

Alternatively we can create a separate discretionary Trust to receive dividends from the Bucket Company. This approach provides greater flexibility to distribute the dividends/profits in the most tax effective way. The new Trust can then distribute according to the Trust deed rather than a percentage of shareholding or a Div 7A loan which will incur interest set by the ATO.

Benefits of a Bucket Company

- Additional Layer of asset protection

- Tap into lower tax rates resulting in huge tax savings

- Provides flexibilty for business to distribute profits to entities and individuals within the group

- Minimise the needs to pay wages and salaries to family members hence the need to pay workers compensation, superannuation and PAYG

- Definitely offers protection in investing profits in other ventures such as property, shares, lending or another business ventures.

Disadvantages of a Bucket Company

- Expensive to set up and run

- The 50% capital gains discount (CGT) does not apply for assets held for more than 12 months by the Bucket Company

- Dividends paid to individuals does not mean that the tax is capped at a company tax rate

- Individuals with shares in the Bucket Company are exposed to asset risk if being sued

- Bank loans to company attract higher interest rates when buying assets or properties

So should you set up a Bucket Company

This question depends on whether you wish to invest in properties and depending on your current financial situations. It is a complex structure which requires an Accountant or a Lawyer who knows this area. This structure is costly to setup and run. Also bearing in mind Company or Trust does not enjoy the 50% CGT discount. And Individuals might be exposed to higher tax liability. This approach a good strategy but it can be get really messy when not executed properly and might attract potential pitfalls.

Refer to the links below: