What is SMSF

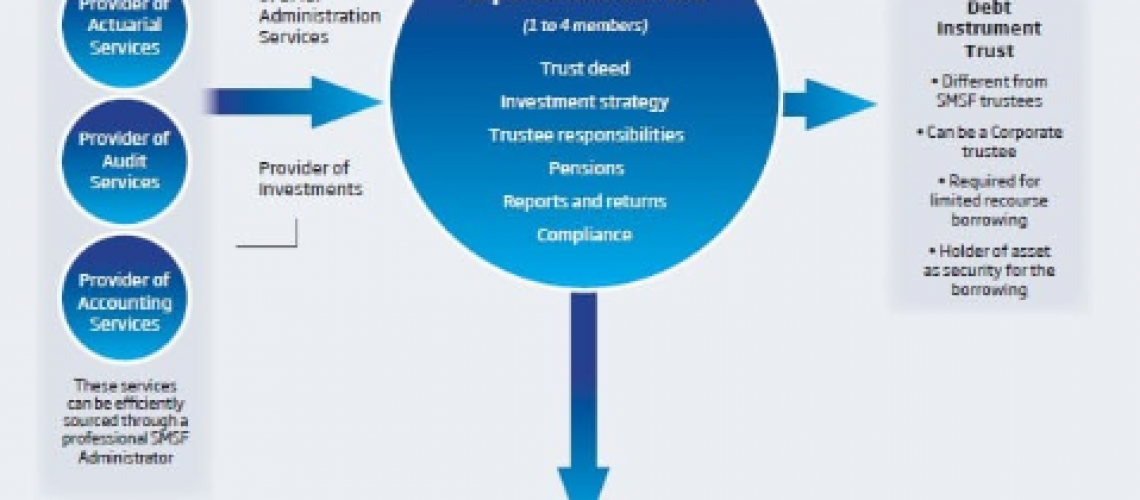

SMSF is a superannuation trust structure which is a private superannuation fund and is regulated by the Australian Taxation Office (ATO) that you manage it yourself for your retirement. It can be setup up to four (4) members. The difference betwee a SMSF and other super funds is that all the members are trustees. Members must be either individual trustee or a corporate trustee. Trustees are responsible for decisions made about the fund and compliance with relevant laws.

How does SMSF work

SMSFs operate under similar rules and restrictions as ordinary super funds.

When you run your own Self Managed Super Fund, as a trustee you must:

- have an investment strategy to follow which is likely to meet your retirement goals and suit your risk profile,

- perform the role of a trustee or a director which requires a duty of legal obligations,

- have sufficient time to manage the funds,

- have time to do research different types of investments – property investments, shares investments, bitcoin investments, funds investments, etc

- have the financial knowledge, skills and experience to make sound investment decision,

- have ongoing budgets for outoing expenses such as accounting fee, tax fee, audit fee, legal fee, etc,

- keep records and ensure an annual audit is conducted by an approved SMSF auditor,

- have insurance to cover for super fund members,

- be for the sole purpose for retirement benefits.

The pros and cons of ownership of fund assets for individual and corporate trustees

The disadvantages of an individual trustee

- It is costly and time consuming to add or remove a member from the fund. The reason being the assets or the funds are in the name of all the trustees.

- Separation of personally owned assets from the SMSF assets are hard to identify as they are in the individual names.

- Personally owned assets are not protected if the trustee is sued for damages.

- Change of title funds is required when there is a change of members and a possibility of incurring a stamp duty to be paid depending on the states the SMSF is originally setup.

The benefits of a corporate trustee

- Assets or funds are in the corporate name which makes it simpler to add or remove a member.

- It is easier to identify and separate assets and funds from the directors’ personally owned assets.

- Directors’ personally owned assets are protected if the trustee is sued for damanges.

- Any changes in the members do not require a change of title, hence no stamp duty needs to be incurred.

Cost of setting up SMSF

- Upfront fee

- Legal fee for advice

- Stamp duty depending on the states the SMSF is setup

- Ongoing fee to maintain and run SMSF

- Bank fee

Useful links – https://www.ato.gov.au/