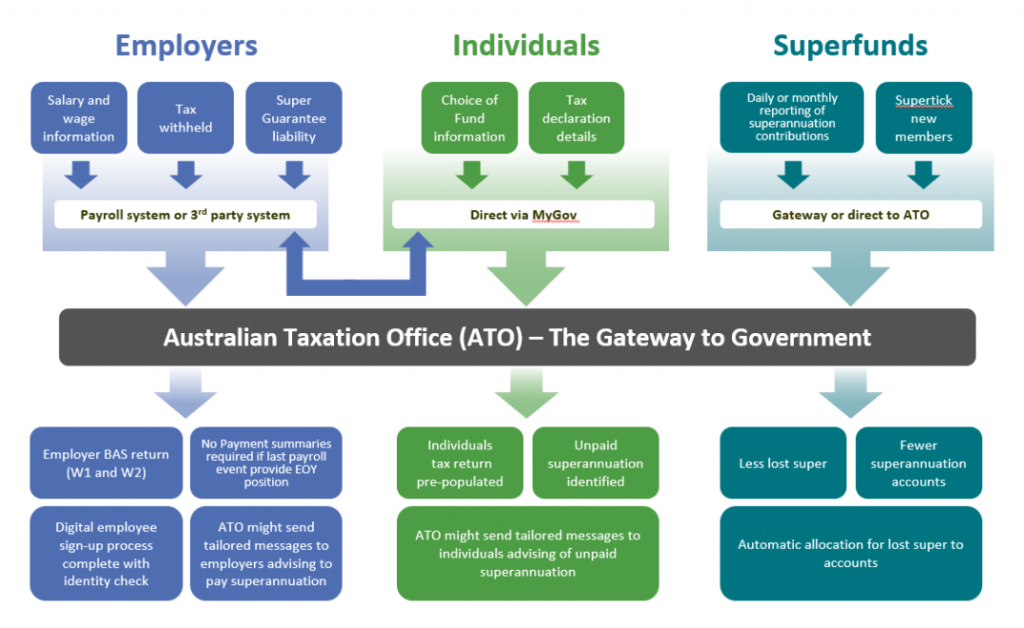

As of 1st July 2019, all businesses must report their employees’ tax and superannuation information to the ATO via single touch payroll software.

Using payroll software to manage employee wages is a key requirement of the ATO in order for small businesses to be STP-ready.

Besides being time consuming, manual methods run the risk of human error as well as the risk of records being lost, stolen or damaged, an ATO spokesperson tells the Intuit hub.

“There are some great affordable digital solutions like cloud-based accounting software and apps for small businesses that help automate record keeping for small businesses, which means they can spend more time working on their business rather than filling in spreadsheets,” the ATO spokesperson says.

Digital technology also makes complying with tax and super obligations easier.

“If small businesses are lodging their own BAS, their software may be able to connect directly with their tax professional or the ATO so they can lodge directly in an authenticated environment,” the ATO adds.

For example, by using cloud accounting solution QuickBooks, business owners can increase their efficiencies across a range of business tasks, including managing cash-flow, getting paid, reconciling their bank and credit accounts and filing GST and BAS.

Main Benefits

- Streamline reporting process to the ATO.

- ATO will be able to pre-fill PAYG sections of BAS for employers and eliminate potential errors and double handling.

- Eliminate the need for employers to general and distribute payment summaries to their employees.

- Employees are able to obtain this information via the myGov website.

Penalties

- Non compliance with STP rules.

- The first 12 months of STP coming into effect, businesses that fail to report on time will be exempt from an administrative penalty.

Failure

- ATO will issue Director Penalty Notices, which may make the directors of a company liable for the company’s PAYG Tax and/or superannuation.

- ATO could issue a Garnishee Notice to a business’ bank account or another party holding money on behalf of, or payable to, a business, or

- ATO will take steps to place a company in liquidation.